The lone coyote works its way down the draw, the towering Bitterroot Mountains glittering with snow behind and above it. An inexperienced observer might think the wild canine is randomly cruising down the drainage, but I know better. It is deliberately and cautiously sniffing its way upwind toward a glob of gland lure I smeared over the branches of a bush yesterday.

That coyote could walk anywhere in the million acres of land surrounding my set, but it doesn’t. It steps squarely on the 2-inch pan of the Number 3 coil-spring trap hidden under the scent branch.

After dispatching the coyote, I admire its fur. My job tonight will be to skin the plush pelt, and then I’ll stretch and dry it on a forming board in my garage. I’ll add the coyote’s pelt to the dozen or so other furs I’ve hunted and trapped this season. In a month or so, I’ll sell the whole lot to a buyer who knows a manufacturer with a contract to make garments. My Montana coyote will probably end up as trim around the hood or the collar of a high-end jacket that’s sewn and sold somewhere overseas.

This process of pelt collection, processing, and sale is repeated thousands of times a year in rural towns around the continent by individuals just like me—small-time trappers who enjoy the challenge of trapping and the opportunity to sell a few pelts to buy more traps and pay for a tank or two of gas to fuel our next check of the trapline. Together, we are the ragtag supply chain for an international retail fur trade that exceeds $14 billion annually.

Country Buyers

The pelt pipeline begins with local fur buyers, known in the lingo of trappers as country buyers. One of them, John Hughes of Roundup, Mont., has developed outlets across the globe for wild furs. Hughes prefers that local fur-takers bring skins directly to his unassuming 40-by-98-foot sheet-metal building, which every trapper for several states around simply calls “the fur shed.” Hughes looks over pelts with an eye tuned by decades in the fur trade, judging them for size, color, quality, and a subjective assessment of the fur called “primeness,” and makes an offer on the spot.

His orders for furs may come from faraway buyers, like a women’s garment manufacturer in Italy, or a fur broker in China. Or he may sell your pelt to a neighbor just down the road.

“There are all kinds of outlets for furs out there,” says Hughes. “Maybe the best outlet is right in your hometown, but it’s on a smaller volume, like a local gal who wants five or six red foxes. She’s willing to pay $75 or $80 for them because she’s going to make a few hats. Maybe it’s not a big order, but you can sell at a premium price. And if you get a lot of them, it turns into something big.”

Hughes has diversified his fur-buying business over the past three decades, often buying unskinned coyotes. These carcasses are called “in the round,” and he buys them for far less than he pays for finished skins. But they also require that Hughes or one of his employees spends hours removing hides from carcasses, and even more hours scraping fat and flesh before washing and pulling skins over forming boards to dry. The finished skins will be sold, but what makes in-the-round animals attractive to Hughes is that he can extract fluids from their bladder and glands to create scent lures, which he sells under the brand name J&M. That’s an important secondary market for Hughes.

State Fur Auctions

Coyote pelts dominate the Montana Trappers Association’s annual fur sale, but other articles—raccoon skins, beaver castor, and marten pelts—are piled high on rows of tables. Each trapper brings the fruits of his season-long labor to the check-in table, where every item is tagged by hand and made ready for fur buyers to inspect. This scene is repeated at dozens of state fur auctions held annually across the country.

Hughes must travel to these sales each year in order to achieve the volume his brokers expect. The actual transaction is curiously old-fashioned, with nary a computer bar code or digital camera in sight. Hughes inspects each lot while his partner follows along with a notebook, writing down details of each potential sale. Other buyers are doing the same. Hughes knows nearly every competitor in the room. “Of the five to 10 buyers at each sale, probably 90 percent of us have seen each other at every sale in the Western U.S.,” explains Hughes.

These state-level buyers each represent several fur brokers, who might be spread from the state capital to cities on another continent. Hughes might be there buying bobcats for someone in Italy and muskrats for someone in China. Other buyers have similar connections.

“At any given state auction, between all the buyers, every fur market in the world is represented,” says Hughes, taking a break from evaluating a table of furs.

The furs aren’t pre-graded or sorted at these state-level sales, and often the sale price has been set in advance. Each trapper’s seasonal take is simply placed in bulk on the table, and the price is generally determined by the country buyer’s outlet. In a year with a low supply of furs, the price might be high, and trappers can make good money. But in years of high supply, the price is correspondingly low, and you can hear the collective grumble of trappers who expected to fetch more money for their hard work.

International Fur Auctions

If you think of the fur trade as a network of spokes, with individual trappers supplying country buyers who then convene on state auctions, the North American Fur Auction (NAFA) might be considered the hub of the wheel. It’s the biggest fur sale on the continent, held four times annually in Toronto and attracting around 700 buyers who might speak a dozen different languages between them. They compete for lots that can exceed 1,000 pelts each in front of live auctioneers. Impressive numbers of skins are separated into grades differentiated by a complicated system involving size, color, fur density, and the discretion of a single fur grader tasked with sorting hundreds of thousands of skins.

Josh Lodge has been the Montana Receiving Agent for NAFA for the past eight years. Lodge’s job is to collect furs from area trappers and make sure they get to the NAFA sales. Each wild fur is tagged with a NAFA bar code and stacked in a warehouse in Toronto with thousands of other skins from trappers like me.

“The grading in a sense is a lot like the Blue Book value for cars. A 2012 Chevy truck will exhibit a lot of different things that will affect the value of that truck,” Lodge explains. A look at NAFA’s grading categories shows extreme color variations and fur quality from localized regions around the country. A Montana raccoon, for example, would likely be graded as a “Western North Central” type, and a muskrat from western Montana would be classified as black versus one from eastern Montana, which would be called red. The distinction is made on the basis of the guard hairs on pelts, which vary by color depending on region of origin.

NAFA fur graders know precisely where each fur came from, and they also know what the buyers expect to see in a particular grade. With literally millions of furs at a single NAFA auction, pre-grading is a necessity. Lots meeting the criteria for a specific grade and quality are packaged by volume, and a small sampling of graded furs is displayed for viewing and bidding. The buyers simply can’t sort through thousands of furs during their limited time on the floor, so they trust that the fur grader got it right.

Unlike at state auctions, where the valuation of furs is dependent on the buyer, NAFA establishes a minimum value for each lot, and if that minimum isn’t met then the fur will be stored until the next sale. This protects the trapper from low-balling buyers, but the trade-off is that if the fur doesn’t sell, the trapper doesn’t get paid. At least not until the next quarterly sale.

Fur Value

In 2014, coyote skins with the distinction of being a “select extra-pale” grade from Montana brought more than $100 each. Other grades with craft-beer-sounding names like “extra-heavy pale” or “extra-pale prairie” skins hit the $80 mark. Grades and prices decline as you move both west and east. In 2014, top coyote skins from eastern Washington and Oregon brought only $35. Fur takers on the opposite side of the country averaged just $20 for their best coyote skins.

The highest prices paid in recent years have gone to Western bobcats, with the top-quality pelts bringing as much as $1,000. Bobcats stretching 40 inches, with wide, white bellies and big, dark spots, continue to fill a hungry niche market that includes trim on collars and cuffs of high-end coats. Places like Montana, Wyoming, and Nevada produce these unique wild skins. Bobcats from other northern states, including Maine, New York, and Minnesota, might bring only $100 for top-quality specimens.

Like prices of other commodities, fur prices can vary widely, and fluctuations are the result of unpredictable factors. A trade embargo in Russia halted the export of several hundred thousand raccoon skins in 2014. At this moment, nearly 700,000 raccoon pelts remain in storage indefinitely in Toronto because of the impasse. The death of a single buyer from Germany dropped the eastern Montana badger prices that same year from $100 to $30.

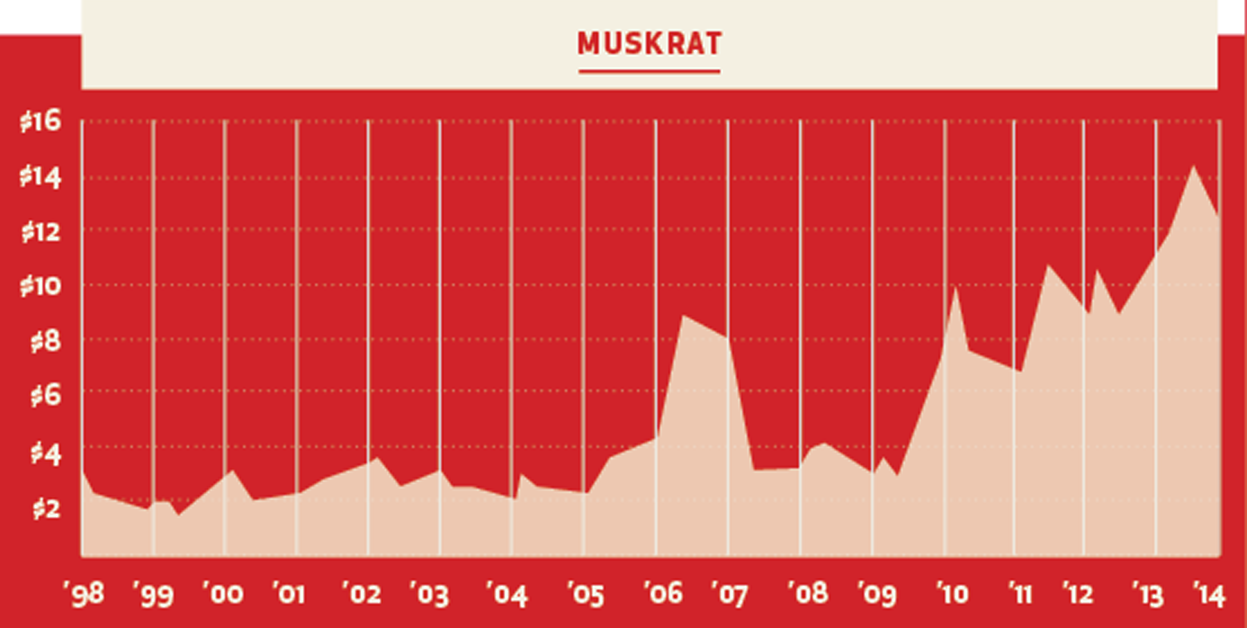

In 2013, Chinese and Korean buyers, who together had bid up the price of muskrats to $12, realized that they wanted pelts for different purposes. The Koreans wanted bellies while the Chinese wanted back skin. Once they recognized they could satisfy their demand with half the number of pelts they had previously bought, the price of muskrats dropped to $6 almost overnight.

A shaky world economy has some buyers scratching their heads about why bobcat prices remain so high. The weak U.S. economy may cause a downturn in prices that were recently enjoyed for Western coyotes, which are used in the domestic trim trade.

And then there’s all that ranch fur flooding the market.

Wild vs. Ranched Fur

The classic view of trapping is one that derives from the romance of the mountain man era: rugged individuals braving the wilderness to make a living on beaver pelts and ermine. The modern reality is significantly different, and it’s a major eye-opener at fur auctions: Most furs for sale at U.S. and foreign markets are not from wild animals. Rather, they are from domestic suppliers, owners of mink farms and other breeders of captive fur.

And it’s this “ranched” fur that is the backbone of the fur trade, says Lodge.

“Wild furs are riding on the coattails of ranch furs, no doubt about it,” he says. “There is more ranched fur produced worldwide than wild fur, and by a wide margin.”

Worldwide production of ranch mink alone is estimated at more than 50 million pelts. The total wild fur produced by fur takers in North America, including every species from red squirrels to coyotes, doesn’t reach 10 million annually. Ranched furs are very consistent in size and color, which enables garment makers to produce uniform product lines. Nature simply doesn’t provide cookie-cutter furs like a ranch can.

Unlike fur farms, the owners of which have the luxury of harvesting skins when they are at peak value, wild fur-takers must work within seasonal constraints established by government agencies, and must suffer the vagaries of weather and geography. But when the prices paid for ranched mink go up, so do wild-fur prices, because wild fur complements ranched fur, especially on collars and cuffs. And it’s the unpredictable whims of the international fashion industry that really drive the fur business.

Retail Sales

Back in the 1970s, major garment manufacturers in New York and Los Angeles purchased raw, dried skins from fur buyers and sent them to dressers (a sophisticated word for tanneries) just down the street, where they were transformed into soft, supple materials.

Workers in the fur-finishing trade punched a clock and stayed busy using special equipment to make herringbone cuts and matching furs with proprietary patterns. Finished garments were displayed at retail stores in the same city where they were made. This domestic trade doesn’t really exist any more. Much of the finish business shifted to Russia in the 1990s, and then to China a decade ago. The few U.S. manufacturers remaining no longer oversee dozens of laborers on the shop floor. Instead, they design patterns and send them along with furs for Chinese workers to cut and sew.

The furs are made into finished garments for retailers like Craig Swick, owner of Paparazzi Furs, who buys the clothing at wholesale prices at trade fairs held annually in the world fashion centers.

“Fur fairs are conventions where manufacturers bring finished garments or samples of their finished garments, and fur retailers go there to select what they want to purchase for their stores,” Swick explains.

“When I started 30 years ago, North America was the number-one place in the world where fur coats were sold,” he notes. “But no longer. Now, the number-one consuming nation for fur coats is China.”

The typical fur buyer in the U.S. has also changed. At his storefront in Big Sky, Mont., Swick has observed that it’s often young women on vacation wandering into his store with male companions who walk out with a new garment.

“It’s not old ladies with trust funds,” Swick says of his customer base. And it’s not people from cold climates, either. Florida, Texas, and California residents on vacation at the Montana ski resort are the top purchasers of garments that range in price from $1,000 to $29,000.

Small-time trappers won’t see a very large fraction of that retail price, but there is a relationship between the cost of raw materials and finished products. For instance, garments featuring bobcat fur spiked in price as trappers put up those $1,000 Western bobcats last year. And, ultimately, the retail price paid for each fur captures all the downstream costs, ranging from the price paid by country buyers for raw skins through middle-man buyers and for the various expenses required to export, manufacture, and then import the finished item.

In 2013, wild-fur prices enjoyed a 30-year high. Since then, prices have been steadily declining, leaving small-scale trappers little financial incentive to buy supplies and spend weeks in pursuit of wild furs this season.

But it’s not all about the money. I’ll be out there setting traps and calling coyotes anyway, simply because it’s fun. And, unlike the mountain men who made the fur trade famous two centuries ago, I can’t just move on to hunting buffalo when the fur market crashes.

The Volatility of Fur

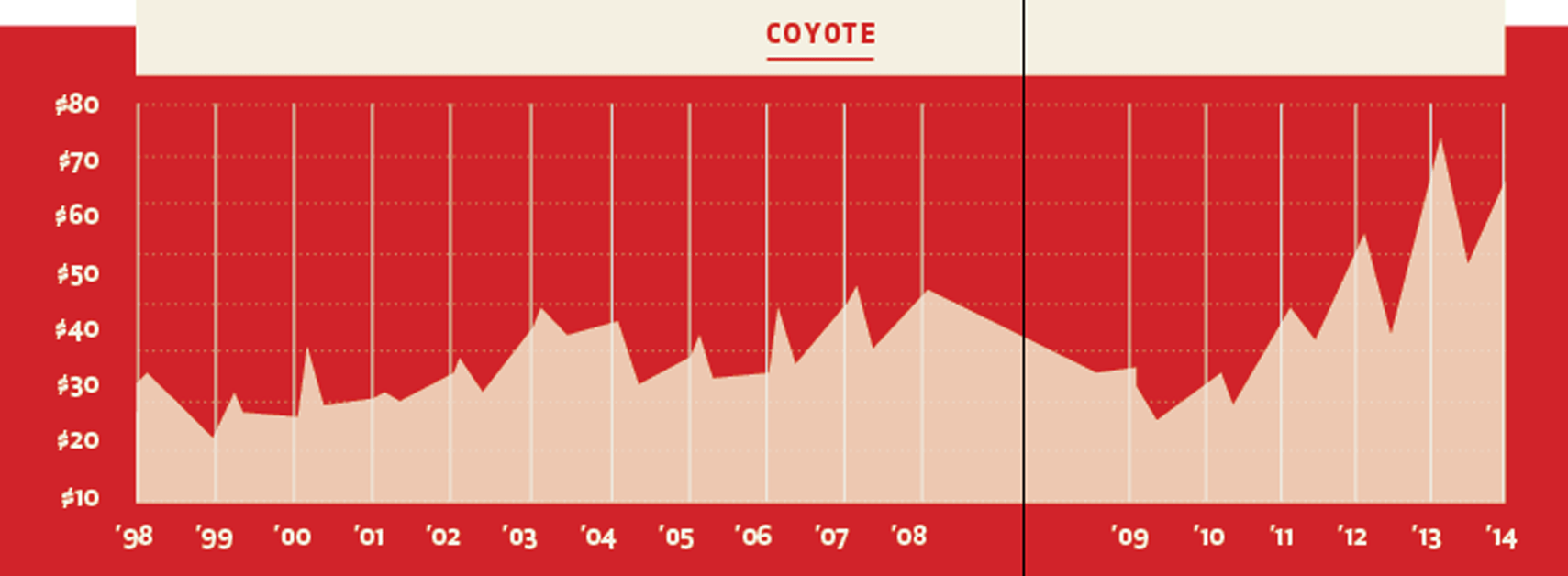

▶ Currency exchange rates. International fashion trends. Gluts of pelts in fur-country warehouses. A lot of variables go into the price that trappers receive for their wild-caught furs. And as these charts indicate, it’s hard to anticipate from year to year how much money you’ll get for your pelts.

The numbers here reflect average prices paid by members of the North American Fur Auction network. The price you’ll receive from local fur buyers will be substantially less, and will be influenced by the quality of fur, the number of pieces sold, and other factors.

The extended gap between ’08 and ’09 is not significant. Rather, it’s the result of printing this chart across a page seam in the February/March issue.

Photographs by Chris Sorensen