Whitetail hunting is divided between the haves and have-nots. Rich guys buy and lease the best properties or book hunts with expensive outfitters while Joe Six-Packs are left to grind it out on public land. It doesn’t have to be that way, at least according to Dan Perez, CEO of Whitetail Properties.

Perez is a baron of whitetail country. His real estate company specializes in selling prime hunting land. Perez might deal mega-farms to millionaires, but his real passion is working with regular guys to buy property they never thought they’d be able to afford. His message: You don’t have to be fabulously rich to get in on this action.

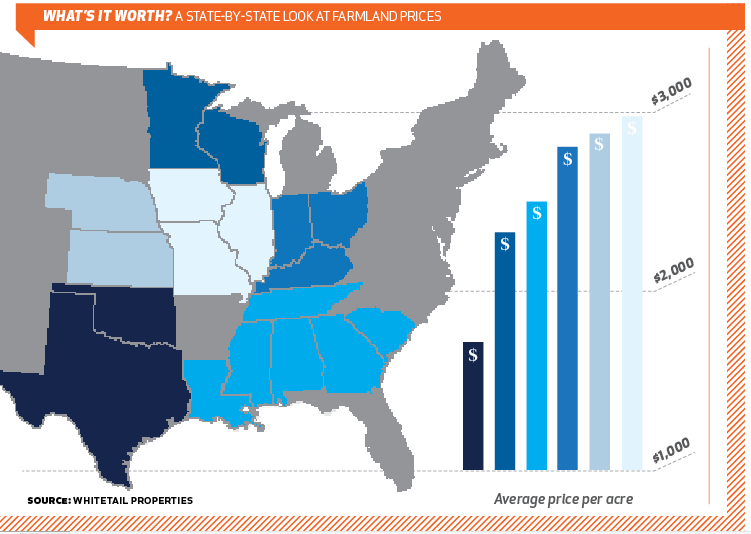

Note: The land values and budget used in this example assume average prices for prime deer hunting ground in the Midwest. Prices will vary by region and property.

Perez says you can own 40 acres that will produce good hunting for mature deer, season after season, for $30,000 down (give or take a couple thousand), plus a yearly payment that’s less than what you’d pay to lease a hunting property. You might not kill a 170-inch buck off the property every year, but you’ll finally have your own piece of ground to hunt and manage how you want. If you play the long game, the property will eventually start making you money. That’s the upside.

The downside is it’s going to take a lot of legwork, smart financing, and a little luck. Plus the necessity that you (and maybe your best hunting buddy) are going to have to come up with 30 large. But consider this an investment, not just a place to go deer hunting. If you need to sell this notion to a dubious spouse, then argue that the right investment in land will produce a much better return than the stock market and probably even your house.

GO WITH THE FLOW

The key to making all of this work is to buy a property that’s cash-flow positive, or at least very close. That means the money coming in from agriculture will total more than your yearly payment (including interest). See the flow chart on p. 66 for details on how this actually works. The basic idea is that 50 to 60 percent of the property will be leased out for agriculture (creating “cash rent”). This is critical for the financial side of things, but it also makes for good hunting. Corn and soybeans translate to high-quality deer food.

It shouldn’t be too hard to find a farmer to rent to (even though your tillable ground of 20 to 30 acres is relatively small), because it’s likely a local farmer is already working the area, Perez says. Talk to neighbors to find out who’s working their land and see if that farmer might want to rent your ground, too.

Perez also suggests visiting your local USDA Farm Service Agency or Natural Resources Conservation Service office to see what options are available for enrolling part of the property in CRP or the Wetlands Reserve Program, both of which provide an annual payment in return for leaving land unfarmed.

LOCATION, LOCATION, ETC.

The only way to consistently kill big deer on 40 acres is to be surrounded by properties that also hold big deer. That means you need to narrow your land search to those counties and neighborhoods that are known to produce mature bucks. Don’t fret over how many good bucks the farm you’re considering currently holds, because the plan is to make habitat improvements and pull in more deer over time. According to Perez, you should care more about how good the neighbor’s farm is—and the next farm down the road. Also, don’t limit your search by size. Sometimes sellers are willing to break a large piece of land into smaller tracts.

GET CREATIVE

Your property might not be cash-flow positive from agriculture alone, but there are some things you can do to tip the financial scales in your favor.

Logging is a good way to improve habitat and turn some revenue from your property. If you can get a logger to pay for mature timber up front, you can use that money to help with the down payment. Also, consider leasing your property out to other hunters. That might sound crazy, but it’s not. If you hunt the farm hard during the archery season, there’s no harm in leasing it out to a couple of guys during the gun season or late muzzleloader season. For this to work, it’s critical that you set solid rules on when they can hunt, what class bucks they can shoot, and where they can hunt (e.g., nobody goes in the sanctuaries, and everybody has a crystal-clear idea of property lines).

THE LONG GAME

Over the years, you can increase the value of your land by creating food plots, cutting access roads, building a cabin, and doing timber-stand improvement. Smart management upgrades, plus a history of killing big deer on a property, will help the value of your property increase more than the general appreciation of surrounding land, according to Perez. You’ll have the option to sell the property and buy a bigger piece, or you can keep on hunting that golden 40 and pass it on to your grandkids. If you decide to sell the property for another piece of land or a different investment, consider a 1031 exchange. You’ll need the assistance of a qualified intermediary, but it’s definitely worth your time to learn about 1031 exchange rules so that you can save money on the taxes.

LAND OWNERSHIP, STEP BY STEP

The play-by-play on how to finance your farm

—Your 40-acre property is in prime whitetail country and sells for $3,800 per acre, costing $152,000.

—You have great credit and put 20 percent down, which is $30,400.

—You’re now financing $121,600 on a 25-year loan at 4.5 percent interest.

—Your annual payment will be $8,112 (including interest).

—Of your 40 acres, 24 are agriculture.

—You have average soil and get $300 per acre for leasing the ag ground, earning you $7,200 cash rent per year.

—You end up paying $8,112 – $7,200 = $912 annually.

—After 25 years, you will have paid about $53,000 for the property, which will now start turning a profit.

—At a 5 percent compounded appreciation rate, the property will now be worth about $514,000.