We may earn revenue from the products available on this page and participate in affiliate programs. Learn More ›

In his four decades of running D&G Sports and Western in Glasgow, Montana, Darrell Morehouse has never seen ammunition pricing and availability as unpredictable as it’s been in the past three years. That’s telling, considering the several ammo shortages he’s seen through the decades.

Sure, some of what Morehouse calls “crazy-ass” dynamics stem from supply-chain uncertainties and binge buying fueled by the Covid-19 pandemic. But his view from the gun counter at an independent sporting goods store in eastern Montana isn’t that different from the business manager of a bullet manufacturer in Utah.

“We’re in reaction mode, just trying to keep up with changing situations almost on a daily basis,” says Michael Painter, director of marketing and product management for Barnes Bullets. “We’re probably better off than a lot of our competitors because we’ve brought so much of our manufacturing processes in-house, but I can tell you that every day is some kind of a new challenge.”

One day it might be a scramble to find a new source of gunpowder that Barnes chooses for its factory-loaded ammunition. Another day it might be absorbing a jump in the commodity price of copper, the metal that Barnes, as a pioneer in the non-lead ammunition movement, requires for many of its products. Another day it might be negotiating terms with the distributors who put boxes of the company’s bullets on the shelves of retailers like Morehouse.

These are uncertain times for nearly every manufacturer that built its business on reliable suppliers, intact supply chains, and predictable markets. Most sectors of the American economy, from restaurants to aviation, are pinched between erratic supply and uncertain demand, both of which are further confounded by inflation. But while firearms makers have more or less emerged from the Covid fog intact—Morehouse says his supply of guns is as robust as ever—ammunition manufacturers are still struggling with a whole bandolier of uncertainties that have made ammunition more expensive and inconsistent in availability and performance than they’ve been in decades. And while many of the wildest swings of the Covid era are working themselves out, the pandemic revealed an industry with some fairly wide performance gaps.

Here’s a look at the various dynamics that are affecting America’s ammunition industry.

Component Availability Is Fragile

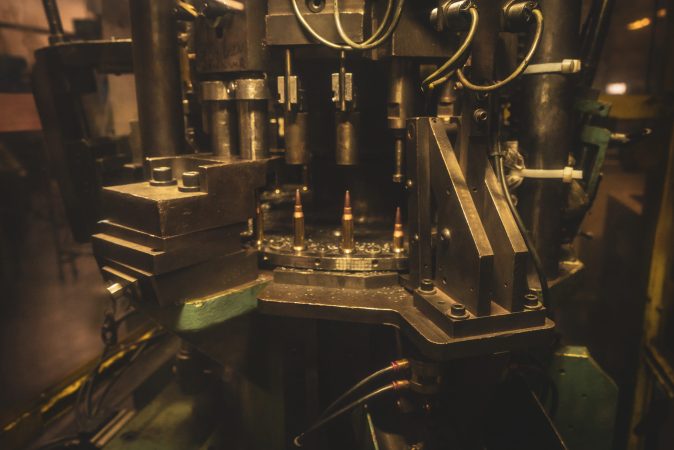

Considering that every loaded round of ammunition consists of four basic parts—hull or cartridge, primer, propellent, and projectile—then the compounding problem of component availability becomes easier to recognize.

Some manufacturers have all the gunpowder they need for their own use. Others have an abundance of cartridges, still others a surplus of projectiles. No one has an abundance of primers.

Some of these components—except for primers—are fairly easy to source from a diversity of suppliers. Others are dependent on global supply chains that have been stressed with Covid-related closures, spiking transportation prices, and unexpected events like the war in Ukraine that has consumed a shocking percentage of the world’s munitions and components.

One of the ways that American brands are getting by—and one of the more closely kept secrets of the ammunition industry—is that competing manufacturers frequently trade components in order to keep their production lines moving.

READ NEXT: Everything You Never Knew About Primers

“Customers may wonder why Company A’s premium bullet is loaded in Company B’s factory ammo,” said one ammunition executive who didn’t want to be named. “It’s not because Company A has so many bullets that they don’t know what to do with them all, it’s probably because Company B traded something for those premium projectiles. The reality is that manufacturers can’t afford for their loading lines to be idle, so they’ll do about anything to keep their production moving,” even if that means making deals with competitors.

If this component swap-a-thon works for most parts of a load, it stalls when it comes to primers. Every interview for this story revealed that primers are the main bottleneck to increased ammunition production. The executive of one ammo brand even asked me if I could help broker primer sales from other sources for this story.

Some of this particular shortage is due to the specific—and changing—technology of primers, but the long and short of it is that primers are specialized high-explosive components that are produced by only a handful of companies, both in the U.S. and overseas.

“If we could solve the primer shortage, we could solve the ammunition shortage,” says Kevin Kilpatrick of Black Hills Shooter Supply, one of the nation’s biggest reloading component distributors. But given regulatory headwinds in the U.S., “trying to site a primer manufacturing facility is like trying to put a high-security prison next to an elementary school.”

That might be so, but Fiocchi, the Italian ammunition manufacturer, announced in November that it is building a $41 million primer manufacturing facility in Little Rock, Arkansas. The press release announcing the plant’s establishment noted that there are only five other primer manufacturing operations in the U.S. At least one other large manufacturer is looking at establishing a primer production operation in order to satisfy demand, but a principal for the company noted that groundbreaking for the new facility is at least a year away.

But another critical component—and one that’s been in constant short supply since the pandemic—is people to run production lines, says Mike Stock, general manager of Winchester Ammunition’s Oxford, Mississippi, plant.

“It’s getting a little better every month, but I could pay an employee all the overtime they would ever want to make right now,” says Stock, whose facility is absorbing part of the $145 million contract Winchester received last year to deliver pistol ammunition to the U.S. Army. “Put it this way, we can’t hire enough people quickly enough.”

Fringe Cartridges Get Sidelined

Winchester’s military contract brings up an important point for larger ammunition manufacturers like Federal, Remington, and Hornady amid the ammo shortage: their production is split between civilian consumers like you and me, and government contracts like the military and law enforcement agencies.

Production facilities churning out loads with broad appeal for civilians and military and law enforcement —the .223, 9mm, .45, and .308—get priority for limited components and congested loading lines. This is part of the reason you’re seeing those chamberings show up at your local retailer sooner and in greater quantities than loads like the .300 Savage or .257 Roberts.

“I’m in good shape with .223, 9mm, and .22s, and am just now starting to see .22/250, .30/06, and .270s come trickling in,” says D&G’s Morehouse. “But .25/06? Forget it.”

Read Next: Hornady’s New 7mm PRC Cartridge, Tested and Reviewed

Then there’s the firearms industry’s seemingly insatiable appetite for new chamberings. Who can forget the 6.5 Creedmoor craze, followed by all manner of 6mm and 6.5mm variants. Recall the 6.8 Western? Or the 224 Valkyrie? Nosler has just about run out of reasonable 20-something cartridge designations. And of course this year’s flavor is the 7mm PRC, which was the talk of last month’s SHOT Show in Las Vegas, where I conducted many of these interviews. This innovation is what keeps the firearms industry fresh and relevant, but these introductions put additional burdens on stressed ammunition production lines.

“At the end of the day, we have capacity constraints on our machines that run projectiles,” says Barnes’ Painter. “I can either produce .30-caliber 180-grain Triple Shocks for one hundred customers or I can produce .325-caliber 200-grain bullets for one or two customers. I have to do what is going to satisfy the most people and is best for our business. In a perfect world, we want to produce all of them, but we have to pick our battles during this time.”

Winchester’s Stock, who brought a number of his production managers to SHOT to investigate new loading machines, notes that obscure calibers or loads with limited popularity may get run one afternoon a month, or on the odd weekend. “It’s not like we ever drop anything from our catalog, so adding these new calibers and loads has an impact on production as a whole. We fit [legacy loads] in where we can, but it’s hard to stop a .223 line in order to make a bunch of .30/30.”

Ammo Prices Increase

Most of the new chamberings are introduced in a brand’s flagship product line and feature premium components and command a premium price. Morehouse says customers’ acceptance of the high price of these flagship products—along with the normalization of scarcity pricing of ammunition during the pandemic—has led to a new high-water mark of ammunition pricing.

“On average, I bet ammo prices have tripled over the last three years,” he says. “Maybe not all loads. I’d guess .30/06 has doubled in price, but if you’re talking premium factory loads, it’s a three-fold increase, and it’s really not going down.”

Morehouse notes that pre-pandemic, he sold 500-packs of .22 long rifle ammo for $20. Now that same SKU sells for $50, and people are happy to pay it. Of course, inflation and scarcity have driven up the price of most consumer goods, from refrigerators to baseball gloves to eggs, but the $21 billion gun and ammunition industry in the U.S. has grown 5.6 percent annually since 2018, according to business analysts. That’s an annualized growth that’s nearly twice the rate of inflation over that same time period.

But John O’Brien, vice president of finance and operations at Sierra Bullets, says customers have accepted that premium ammunition comes with a premium price.

“I think the shortage made people rethink the value proposition” of ammunition, he says. “They figured if they could only buy a box or two of ammunition, they were going to buy the best there is. And so people got accustomed to paying north of $50—sometimes way north—for premium loads.”

Hoarding, Panic Buying, and Covid Loads Are Reality

Any conversation about ammunition dynamics has to include the toilet-paper analogy. Recall in the early days of the Covid-19 lockdowns how crazy we all were for toilet paper? We either couldn’t buy it because it wasn’t available on retailers’ shelves, or when it was available we bought it all because we weren’t sure when it would be available again.

Substitute rifle loads or shotgun shells for toilet paper, and you have a good idea of how the pandemic affected ammunition sales and availability. Shooters hoarded ammunition not only out of concern for personal protection in unsettled civil society, but also as a sort of hard currency; in case the economy collapsed they could always trade ammunition for food and services.

“I had people—customers I’ve known for 30 years—come into the store and tell me that they had 50,000 primers, but they were looking to buy more,” says Morehouse. “What the hell? They’re never going to shoot up all that inventory in their lifetime. But that sort of defined our ammunition sales during Covid. If we got a box, we sold it for maybe twice what it was worth pre-Covid. And we still could not keep ammo on our shelves.”

Hoarding has had an outsized impact on availability of ammunition, but also on shooters’ acceptance of what they’d pay for a box of shells. It also affected retailers’ tolerance for carrying risk. Morehouse says he has increased his margins slightly on ammunition sales, but he says it’s wrong to blame retailers for price-gouging.

Read Next: Scalpers Are Driving Up Ammunition Costs and Contributing to the Ammo Shortage

“At one point, I had over a million dollars in orders that hadn’t been delivered,” says Morehouse. “That’s just not manageable for most small retailers. But my supplier told me in 2020 that I should put in a big order. I didn’t receive it, so in 2021 they said I should back up my order, just to make sure I was in line. I didn’t get that, either, so I backed it up again in 2022. Now, in 2023 I’m all of a sudden getting three years’ worth of orders that I have to find room for, and money to pay for. But you don’t dare send it back because you don’t know if you’ll get it again. In most cases, we’re just passing on [to customers] the higher prices we’re seeing from manufacturers and wholesalers.”

In Henderson, Nevada, gun-store owner Greg Veire deals mainly in bulk ammunition for recreational shooting. He thinks the days of hoarding are over.

“In the past year, we’re seeing more customers come in and grab what they need for a day of shooting,” says Veire, owner of Bear Arms. “That’s definitely not what we were seeing a couple years ago, when people would come in and clean us out and didn’t have any intention of shooting it soon. If ever. We still have customers who come in and buy three boxes instead of one, but I think that’s just because they don’t know when they’ll be able to get a certain caliber or load. But I wouldn’t call that hoarding. I call it hedging.”

In some cases, customers are buying multiple boxes from the same lot or case out of a belief that each shell will be more consistent from shot to shot. That theory stems from what some shooters call “Covid syndrome” ammunition. While there is little data to support the claim, some shooters say that during Covid factory ammunition suffered from inconsistencies based on different propellants and primers.

“I know the basis for the claim,” says one ammunition manufacturer. “During Covid, we might swap in primers that we got from offshore suppliers or a substitute powder if we couldn’t get our preferred powder. But we also spent a lot of time making sure that the burn rates and velocities were pretty-danged close to the original. You might see some extremely minor variation, but it was no more than the standard deviations you might see from lot to lot in just about any factory ammunition.”

This use of swapped-in components based on availability remains a fixture in the ammunition business, even as acute Covid-related shortages are easing. Federal doesn’t define the specific projectile in its new Gold Medal CenterStrike match load, introduced at last month’s SHOT Show, for instance. That flexibility allows Federal to trade in whatever bullet it has available that will still deliver the precision that shooters expect from the premium match load. And, just as importantly, keep the production line moving.

The Future of Ammo Availability Is Looking Up

Mark Bickish fielded plenty of interest from ammunition executives at last month’s SHOT Show. Bickish is director of sales for Alpha Loading Systems, a small Montana manufacturer of high-volume loading equipment that doesn’t take much physical space or personnel to operate.

“We can get you started producing high-quality ammo with a $500,000 machine,” says Bickish. “Federal and Winchester don’t like us very much.”

The folks quizzing Bickish about his products included large manufacturers looking to increase loading capacity or to replace machines that have been running nonstop for the past three years. But most interest in Alpha’s loaders came from small ammunition makers just getting into the business.

“These guys are young and hungry, and as long as they have a line on components, we can get them into the market pretty quickly,” says Bickish, who was one of maybe two dozen industrial ammunition loaders displaying their wares at SHOT Show. “I think people are seeing that this is a business with a lot of demand and frankly not a lot of supply. So if you can deliver supply….”

That bullish outlook post ammo shortage is shared by Dave Pagels, director of North American sales for Bliss Munitions Equipment in Michigan. Bliss makes larger machines and loading lines, and while their customers traditionally have been the big ammo companies, they’re increasingly selling to small and mid-sized brands.

“Ours are not small machines,” says Pagels. “Our 9mm loader can cost over $5 million, but the demand is so high that once it’s set up and online, the payback for that initial investment is about 1.5 years. It’s a money-maker. If you have the capital right now to get into a premium loader, it’s a pretty quick return on the investment.”

Nearly every source for this story said that while component and personnel shortages have stressed the industry, the outlook is positive, especially for smaller niche brands that are nimble enough to react to conditions and which sell a specialty product.

“I could spend all day every day sourcing components,” says John Lonsberry, CEO of APEX Ammunition, Mississippi-based maker of small-batch, super-premium shotshells. As the pioneering producer of TSS, or tungsten super shot, APEX’s business is predicated on obtaining tungsten. “It’s not just a commodity, it’s jewelry, a precious metal that’s very much affected by market fluctuations. But if that’s what your business relies on, then you find a way to make it work. If one supplier lets you down, you find another. If the price spikes, you find a way to cushion that impact.”

There is presumably more cushion for ammunition at the upper end of the price spectrum. APEX’s 12 gauge TSS turkey loads sell for more than $60—for a box of five shells.

If material shortages, supply-chain disruptions, and unpredictable demand are all evidence of an industry in flux, it’s also true that infrastructure investments in primer production and in sourcing raw materials for components are examples of free enterprise at work. So is the unifying theme that every source mentioned: Rapid investment in adding capacity to their production.

“It’s hard to take a bullet off the press when we still have backorders to fill,” says Sierra’s John O’Brien. “But building a much wider variety of bullets and covering all our product lines is a big priority for us this year. At the same time, there are some cool new cartridges that we’d love to jump on.”

Will Sierra start loading the new 7mm PRC?

“Not yet,” O’Brien told me, “but if you have a lead on shells we will.”